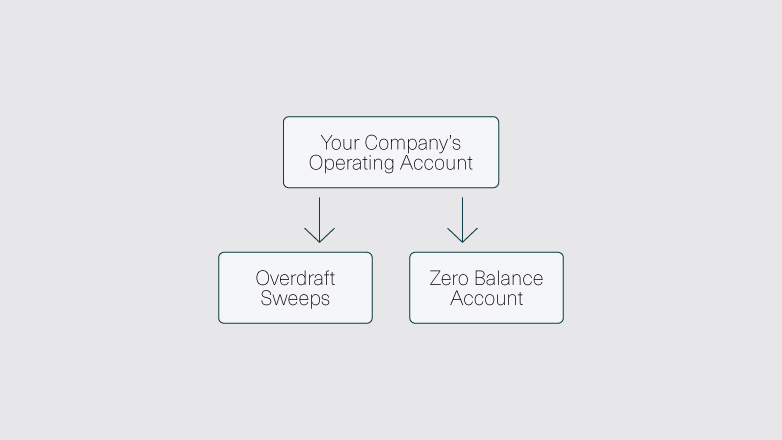

In this environment, in which advisory conflicts are under intense regulatory scrutiny, what the SEC is now reacting to is the potential for undisclosed conflicts related to the compensation received by the adviser or its affiliates in connection with bank sweep accounts. While press reports and related staff statements have referred to “advisory account” cash sweep programs, a cash sweep program is offered via broker-dealer accounts which underlie an advisory program. It is also noteworthy that investments through a cash sweep program are specifically addressed and permitted by the Securities Exchange Act of 1934 and in particular, the net capital rule.īank sweep accounts have been associated with advisory programs for many years. In connection with their advisory programs, dual registrants often make available programs for cash in an account to automatically be swept into an interest-bearing Federal Deposit Insurance Corporation (FDIC)-insured deposit account or a money market fund. 2īank Sweep Accounts as Part of Advisory Programs.

Sweep account example full#

This is a clear conflict and, without full and fair disclosure, investors cannot make an informed investment decision to agree to the adviser’s cash sweep vehicle selection. These types of cash sweep arrangements create an obvious incentive for an adviser to recommend products where revenue sharing will result in larger payments to the adviser and lesser returns for the adviser’s client.

In fact, in some cases, these arrangements may actually lower the interest paid to the client.

In some cases, the revenue received by the adviser or the adviser’s affiliate far exceeds the interest earned by the client on its cash. The clearing broker may, in turn, agree to share a portion of the revenue it received with the investor’s dually registered investment adviser or with the adviser’s affiliated broker-dealer. In some cases, the bank, often an affiliate of the clearing broker, agrees to share a portion of the revenue the bank earns on the investor’s deposits with the clearing broker. The Commission has brought enforcement actions in the past where advisers have failed to make appropriate disclosure.Īs another example, some clearing brokers offer bank deposit sweep programs where an investor’s uninvested cash is swept into an interest-bearing bank account. Advisers recommending or choosing between different money market funds must make full and fair disclosure of these types of conflicts to their clients. For example, some money market mutual funds carry 12b-1 fees or make revenue-sharing payments that may be shared with a dually registered adviser or an adviser’s affiliated broker-dealer, while other money market funds do not carry those fees. A dually registered adviser or an adviser with an affiliated broker-dealer may have a financial interest, a conflict, in recommending one cash investment over another.

Cash in advisory accounts is often automatically swept into a money market mutual fund or a bank deposit sweep program. We are also looking at cash sweep arrangements. A recent speech by Stephanie Avakian, Co-Director of the Division of Enforcement, indicates where the SEC is heading. Coming on the heels of the share class initiative, 1 the US Securities and Exchange Commission (SEC) is at the initial stages of another initiative involving concerns about adviser disclosures and conflicts related to bank deposit sweep programs (BDSPs).

0 kommentar(er)

0 kommentar(er)